Home >> Blog >> What is Return on Net Worth?

What is Return on Net Worth?

Table of Contents

The term "Return on Net Worth Ratio" (RoNW) is similar to the term "return on equity ratio" (ROE). The ratio demonstrates how much profit a business makes using equity shareholders' capital. Consequently, it is also known as the return on equity ratio. This ratio can be helpful when comparing a company's profitability or yearly return to that of rivals in the same industry.

What is RoNW?

Return on Net Worth (RONW) is a formula that expresses a company's profitability as a percentage. The company's net income is divided by shareholders' equity to determine the RoNW. As a result, the investor's viewpoint, not the company's, is used to build the ratio.

Net Worth Return Calculation

Net income and shareholders' equity are included in the RoNW calculation or return on net worth ratio. Net income refers to a company's profit for a specific fiscal year. The total revenue and liabilities must be subtracted to obtain the annual net income. The money that shareholders have invested is referred to as shareholders' equity. The RoNW formula is as follows:

Annual Net, Worth of the Company/Shareholder Equity Capital, Equals Return on Net Worth. Let's compute the ensuing:

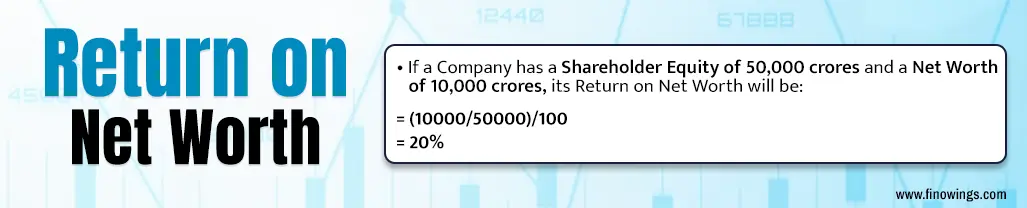

If a company has a shareholder equity of 50,000 crores and a net worth of 10,000 crores, its return on net worth will be:

= (10000/50000)/100

= 20%

The ratio demonstrates the profit a business may make from its shareholders' equity.

Interpretation of RONW

To determine if the company has been more or less effective at earning profits on shareholders' equity over time, it is critical to examine this measure throughout a number of time periods.

Additionally, a decrease in the value of shareholders' stock can cause an increase in RONW. As a result, a share repurchase may artificially boost the return on equity, leading analysts and investors to assume larger profits or increased efficiency incorrectly. Therefore, it's crucial to consider the ratio before drawing any conclusions about the company under study.

When paired with return on assets (ROA), return on net worth can reveal whether a company is using leverage. For instance, if ROE is higher for the same time period than ROA. As more debt is taken on, fewer shares of equity are needed, which will enhance ROE, indicating that leverage is being used to boost profits.

If the companies are not comparable in terms of the business cycle and industry, the measure may not be relevant when comparing other companies based on their RONW.

For instance, since technology companies often have lower debt levels than utility companies, comparing the RONW of the two organizations may not provide an accurate picture. Utility firms, on the other hand, typically have significant debt levels. Additionally, utilities are often stable businesses, whereas technological companies typically see higher growth, making it inaccurate to compare the ROE of these two industries.

Return on Net Worth Ratios: Positive and Negative

Positive:

It implies that the business has excellent management for increasing shareholder returns. This shows how effectively a business can use its investments to boost output and profits. In addition, it demonstrates that the business can produce additional assets to offset its liabilities. As a result, it is unquestionably a secure investment option.

Negative:

Conversely, a diminishing return on net worth suggests that the corporation is making poor decisions and that its equity management efficiency is extremely low. Therefore, a company with a low return on net worth will have more debt and is not a good investment for investors.

A company with a high RoNW ratio is preferred by investors since, as I previously indicated, a lower return on net worth is not beneficial for investing. The high-to-low ratio can be calculated using a specific scale. A minimum return on net worth of 15% denotes a stronger stock valuation and more profitable stock. In contrast, a return on net worth of less than 10% is considered undesirable for a company.

What is the Optimal Return on Net Worth?

A company's RoNW ratio is considered to be at a minimum if it is 15%. This indicates that the business is at least stable and is expanding gradually.

A RoNW ratio of less than 15% is undesirable since it indicates that the company's financial health is not strong.

On the other hand, if the RoNW ratio is greater than 20%, the business may be financially successful. You can confidently invest your funds in that company's stocks as an investor or trader.

Some businesses have a RoNW ratio that is higher than 100%. These companies also have very lucrative stock markets.

Conclusion:

A ratio called return on net worth is determined from the standpoint of the investor rather than the enterprise. By examining this, the investor can determine if he will earn the full net profit or how much return he will receive. It explains how businesses turn a profit using the money of their shareholders. We must closely monitor a company's return on net worth if we choose to invest in its stock (RoNW). Although all taxes are not included in net worth, dividends are.

Author

Frequently Asked Questions

Return on Net Worth (RoNW) is a financial measurement that determines how efficiently a company generates profit from its owners' equity (also known as net worth). It shows the portion of net income that was returned to shareholders as a return on their investment.

The formula for RoNW is,

RoNW = (Net Profit after Tax / Equity of Shareholders) × 100

Net Profit after Tax = The company's profit after all costs, taxes, and expenses.

Equity of Shareholders = Total assets less total liabilities (or equity share capital plus reserves and surplus).

RoNW and ROE have almost similar interpretation. They both tell you how much profit a company is making from the shareholders’ funds.

RoNW works around the return, which company has been generated from its “net worth” net worth means aggregate of equity share capital and reserves and surplus.

ROE is centered on calculating profitability on “equity” which consists of the Shareholders capital and reserves but may also sometimes make adjustments for preference shares or other components as per specific analysis.

Although it varies depending on the situation, a 12% Return on Capital Employed (ROCE) is typically regarded as acceptable to good:

12% is a good ROCE if peers have ROCEs of 8 - 10%.

But 12% is below average if counterparts display 15-20%.

A good RoNW (Return on Net Worth) varies from industry to industry, however, you can take as thumb rule-

- More than 15% is typically considered good, meaning the company is efficiently using its shareholders’ money to earn a profit.

- Above 20-25% is very strong and indicates an excellent profit margin and competitive advantage.

- Above 10% is considered decent and anything below about 10% may signal either: poor performance or on the other hand, that the equity capital is not being used effectively in case an asset-rich business (e.g. utilities, infrastructure).

In the stock market, a company's return on net worth, or RoNW, indicates how well it uses the money invested by its shareholders to create a profit.

Better profitability and a positive indication for investors are associated with higher RoNW.

Generally speaking, a RoNW above 15% is seen as good. It aids in evaluating managerial effectiveness and comparing businesses.

.webp)