Home >> Blog >> The Ponzi Scheme

The Ponzi Scheme

Table of Contents

The Fraudulent Scheme of Investment- The Ponzi Scheme.

Investment is an important decision made with experts' and guides' help. Investing in any scheme, an investor's first step is to investigate. An investor analyses the company's business to interpret its financial performance, ultimately determining the investors' profit or loss. Many investment schemes are available in the market. A wise investor looks for the safest and most effective investment scheme to invest his hard-earned money. Not every financial scheme provides great returns and profits to an investor. Every financial scheme has risks, and every investor in this business knows these risks. But an amateur investor looks for those schemes that provide quick and large profits. Unfortunately, in their greed, they often stumble upon many fraudulent schemes that bluff the investors with their fake promises and profits. These scams are surprisingly very common, even for well-educated investors. One of the most popular and earliest scams is the Ponzi Scheme.

What is a Ponzi Scheme, and how did it start?

The Ponzi scheme is a fraudulent investment scam. This scheme ensures its investor's high returns in less time and with no risks. The method by which this scheme provides its first fake returns is by taking the money from its newly found investors to the previous investors. This cycle keeps on until the fraud firm runs out of new investors; therefore, their show ends, and by them, the people are left bankrupt.

The rise of the Ponzi Scheme

In India, more than 10 thousand cases have been reported in the past five years related to the Ponzi scheme, and the number of cases keeps rising yearly. So how did this scheme start, and why is it called a Ponzi scheme?

The term "Ponzi Scheme" was named after a scammer named Charles Ponzi in the 1920s. However, Charles Dickens' novels Martin Chuzzlewit and Little Dorit, released in 1844 and 1857, respectively, and published before Charles Ponzi's plan, both explain the techniques used in what became known as the Ponzi Scheme. In addition to fiction, Sarah Howe in the United States and Adele Spitzeder in Germany had written about actual occurrences of these scams in the mid-to-late 1800s.

The original Charles Ponzi scheme, which took place in 1919, was related to the US Postal Service. The money made through the postal service then was complicated for common people. It was based on the sale of coupons, a type of exchange known as arbitrage. This business was not an illegal practice. Because arbitrage is a process of buying and selling the same asset simultaneously in different markets to profit from small differences in the commodities' listed prices. But Charles Ponzi was not interested in those small differences in profit anymore. He became greedy and expanded his efforts.

With the Securities Exchange Company, which Charles Ponzi founded, he made returns of 50% in 45 days or more than 100% in 90 days.

Due to his previous success in the postage stamp scheme, Ponzi had built trust, and his previous investors were attracted to his new business. Instead of investing the money he took from the investors, Ponzi redistributed it to other investors and told the investors that they had made a profit. The Boston Post became suspicious and started investigating the Securities Exchange Company. The scheme or scam was truly discovered in August of 1920. Federal authorities arrested Charles Ponzi on August 12, 1920, and he was charged with several mail frauds. Charles Ponzi was given a five-year prison term in November 1920.

Ponzi Scheme in Modern Times

After the incident of Charles Ponzi, whichever fraudulent scheme similar to Charles' scam came forward anywhere in the world was called a Ponzi Scheme. He became the father of the Ponzi scheme. One similarity which every Ponzi scheme include is it is based on a very new idea. This innovative idea of a business firm seems very attractive to the public. The Ponzi scheme idea did not catch on until 1920. After that, both technology and the Ponzi scam evolved. One of the most famous examples stands in the Stock market. In 2008, Bernard Madoff was caught running a Ponzi scheme. In his scheme, he misled trading reports to show his investors that they were earning a profit on investments that didn't exist. Investors started withdrawing money from Madoff's company during the 2008 Global Financial Crisis, which ultimately revealed Madoff's firm's financial fraud. Madoff ultimately acknowledged that his company owes roughly 4,800 customers a total of $50 billion in obligations. He received a 150-year prison term, and the government seized his $170 billion in assets. On April 14, 2021, Madoff passed away in custody.

No matter what technology is employed in the Ponzi scheme, most have similar traits.

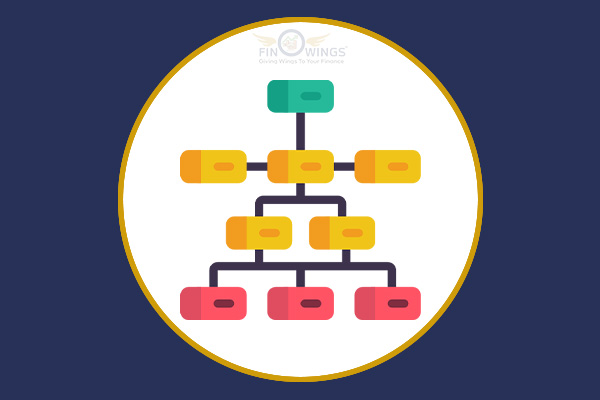

Another new example of an innovative Ponzi scheme is the GainBitcoin Scam. Discovered in April 2018, this was a crypto Ponzi scheme that Amit Bhardwaj designed. It was a multi-tiered scheme where Amit held the top position above his 'seven stars,' who used to handle all the operations in India and other countries. Approximately 1 lakh victims had lost over Rs 1 Trillion in the GainBitcoin scam. The firm promised its investors or victims a 10% monthly return in Bitcoin-on-Bitcoin deposits for 18 months through multi-level marketing programs. However, the investors later realized that the number of Bitcoins (BTC) is limited and that the return guarantee is impossible. The situation became more difficult after the sudden death of Amit Bhardwaj due to a heart attack in 2022.

How can an investor identify a Ponzi scheme?

The SEC (Securities and Exchange Commission) has highlighted the following characteristics that can be used to identify a Ponzi scheme.

* A firm that guarantees and promises high returns with little to no risk in a short time.

* A consistent flow of returns or profits regardless of market conditions.

* Investments that are not registered under the Securities and Exchange Commission (SEC)

* The fraudulent firm claims investment strategies that are confidential or described as too complex to explain.

* The firm's clients are not allowed to view the official paperwork for their investments.

* Clients face difficulties taking back their money or investments.

All the Ponzi schemes are reported to the Serious Fraud Investigation Office (SFIO). It is regarded as a serious crime, and a victim can report it under the Prevention of Money Laundering Act (PMLA). Ponzi schemes are banned in India under the Prize Chit and Money Circulation (Banning) Act of 1978.

A Basic Example of a Ponzi Scheme to educate common people.

Here is a typical illustration: Suppose Anil (a corporate manager) guarantees his friend Mohit 10% returns. Anil gives Mohit) 1000, anticipating the investment will be worth 1 000 in a year.

Next, Anil promises 10% returns to his friend Suman. Finally, Suman agrees to give Anil ₹20000.

With ₹30000 now on hand, Anil can repay Mohit by paying him ₹11000. Additionally, if Anil thinks he can convince future investors to give him money, he is allowed to steal $1000 from the pool of cash as a whole.

For this scam to work, Anil must continually get money from a new client or investor to pay back older ones.

Conclusion

Clients who give money to their financial advisers or investment firms expect them to work professionally to provide them with all the financial services and benefits. Unfortunately, Ponzi schemes can be used to fraudulently mismanage these funds. Ponzi schemes are not real investment plans because they use the funds of one investor to pay another. They are dishonest investment schemes that have cost billions of dollars. The Ponzi Scheme works on two important factors: high returns, where a client is promised or assured large profits in less time. And the second one is referral income. The firm provides a commission to its clients who bring new investors to the company. For a Ponzi scheme to work effectively and largely, the scammers look for friends and families who refer each other to invest in their firm because, normally, people do not trust an outsider while investing their money. To gain this trust and investors, the managers of the Ponzi scheme always introduced referral schemes that would bring in new investors through the greed commission. In a way, a Ponzi scheme backfires on innocent people targeted by their lack of financial knowledge and greed for easy money.

.webp)