Home >> Blog >> How to become a Crorepati with a SIP Investment of 10000 Per Month in a Mutual Fund

How to become a Crorepati with a SIP Investment of 10000 Per Month in a Mutual Fund

.jpg)

Table of Contents

- 1. Introduction

- 2. Is it possible to invest 10,000 and become a crorepati?

- 3. What Is a SIP or a Systematic Investment Plan?

- 4. Benefits Of Investing In SIP

- 5. Here are a few steps that you must take to fulfill the dream of wealth creation or to become a crorepati:

- 6. SIP In Different Mutual Funds

- 7. Patience Plays a Key Role While Investing

- 8. Apply Mutual Fund SIP 10/15/18 Rule

- 9. Final Thought

1. Introduction

Every one of us dreams of becoming a crorepati at some point. But is it so easy to become a crorepati? There are two ways for a commoner to become a crorepati- first, he can become rich or a millionaire by doing business and, secondly, by investing. Investment is the only way to increase your hard-earned money continuously. Becoming a millionaire or crorepati by doing business is a little easier than investing because there are many aspects to keep in mind while investing. To become a crorepati, we have to make the right plan constantly. Yes, even with a monthly SIP of Rs 10000, you can become a crorepati and fulfill your dream. Today in this blog, we will discuss how to invest Rs 10,000 to become a crorepati or get maximum returns. Keep reading.

Becoming a crorepati through investment is not going to be accessible from anywhere. It is possible to do this only when you have patience and are ready for long-term investment. However, with the proper planning, you can become a crorepati soon. There are various investment options available in the market today wherein an investor can proceed towards building the wealth of their dreams by systematic planning and carefully choosing the right investment plans.

To become a crorepati, you must easily choose the right stocks or mutual funds to invest in using a Systematic Investment Plan (SIP). One thing to be sure of is that if you go for a long-term investment, your chances of getting good returns are also high. Many factors must be considered when an investor hopes to generate wealth and earn good returns by investing through the right channel. For example, how much money are you investing and for how long?

2. Is it possible to invest 10,000 and become a crorepati?

Robert G. Allen once said, "How many millionaires do you know who have become rich by investing in savings accounts? You must have come to know the importance of investing. I rest my case."

In today's time, everyone wants to invest, but only a few people know how to invest their hard-earned money wisely. You can become a crorepati in 15-20 years by starting a SIP of Rs 10000 monthly. Do you know that you can build a considerable corpus even by investing a small amount in SIP? In addition, SIP investments reduce the impact of market volatility.

There is no doubt that consistently earning good returns through investments is quite challenging, but it is possible. By investing in the right investment plans, you can expect guaranteed consistent returns and move towards becoming a crorepati.

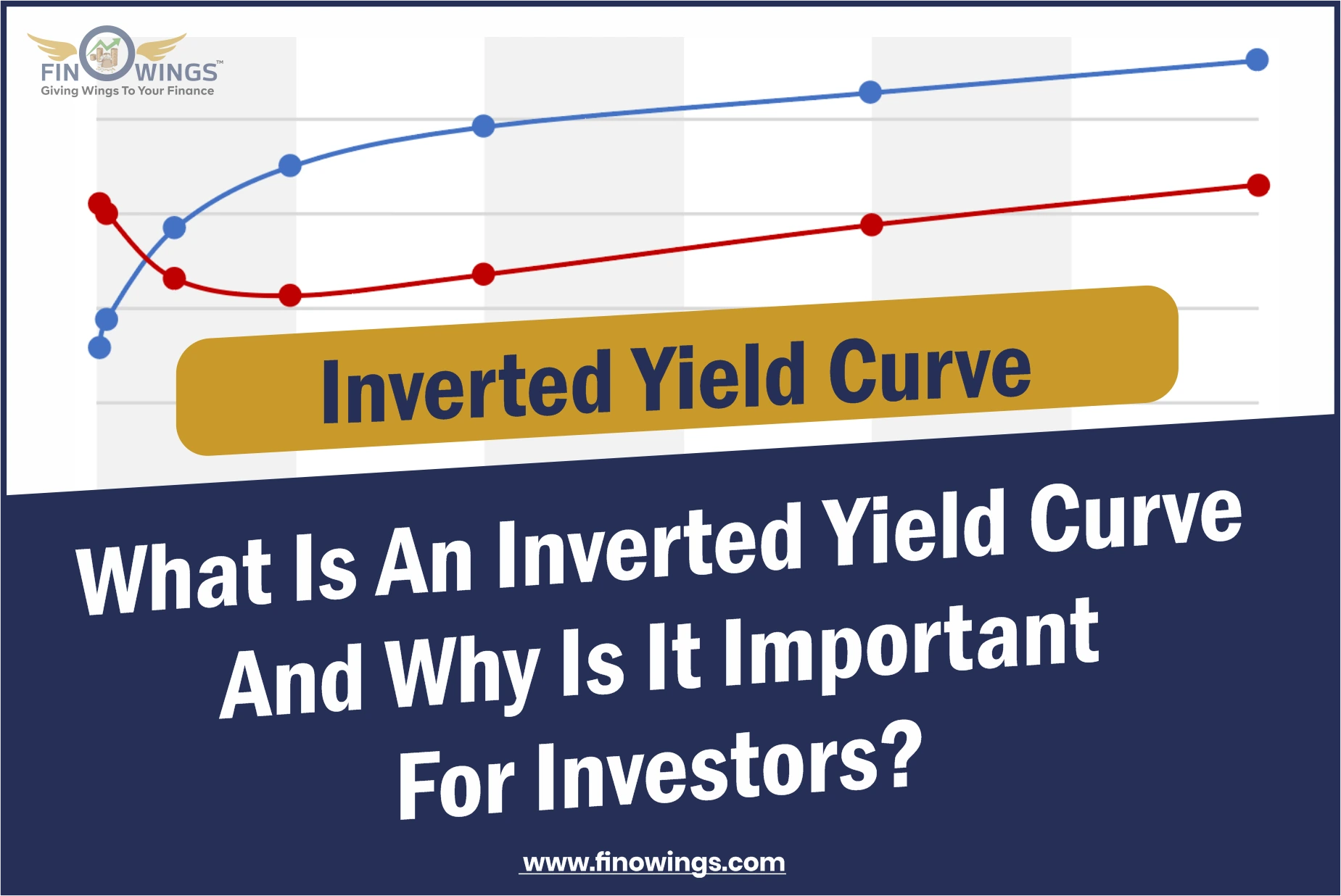

3. What Is a SIP or a Systematic Investment Plan?

A SIP is one of the best and easiest ways to invest in Mutual Funds. Of course, there are other ways to invest in mutual funds, but if you're looking for good returns with reasonable risks, then SIP is the best. This process is used when you regularly invest without making huge investments.

When you go for equity investment through SIP, your stock goes into the market, but it ensures that you get regular returns over time, and your money keeps growing.

Before investing in such schemes, investors must ensure their financial position, sustainability of investing, and risk appetite.

4. Benefits Of Investing In SIP

4.1 Rupee Cost Average

The notable advantage of SIP is the rupee cost averaging, which helps an individual to average the purchase cost of a property. When a person invests a one-time large sum in a mutual fund, they buy a certain number of units in one go, but SIP differs. Equity is bought through SIP over a long time, usually monthly. Due to the spread of SIP investment, the chances of profit from the stock market are high. Moreover, monthly SIPs help invest in the stock market at different price points, thereby giving the investor the benefit of rupee cost averaging.

4.2 Power Of Compounding

As we all know, how much power is involved in compounding? SIP also gives you the benefit of the power of compounding. In the case of compound interest, the interest amount is added to the principal and is calculated on the new principal. Since mutual funds invest in installments through SIP, this process continues again and again, and the interest earned on it is in the form of compound interest. Therefore, compound interest is higher as compared to simple interest.

4.3 Affordability

The most important thing about SIP is that it is very economical to start saving on it. So a commoner can get good returns by investing in it. You can start investing in SIP with a minimum monthly installment of Rs.500. Some mutual fund companies also offer "MicroSIP" to their clients, in which you can start investing with as low as Rs 100. But if your dream is to become a crorepati, then you will need to invest much more than this.

4.4 Risk Reduction

Since the SIP is spread over a longer process, the stock market catches any ups and downs in advance. Thereby, SIP ensures to buy lesser investment installments of its investors. Hence, it is the plus point of SIP.

In SIP, one can start the investment journey with a minimum amount of Rs. 500. Being a sensible investment, it is the most economical means of investment for most people. There is no age to invest; you can create a significant corpus for your future by investing less money at a young age. SIP is best known for its goal planning for investors. Investors also make and fulfill their long-term financial goals through SIP.

Some of these are given below:-

-

Buying a car

-

Buying a house

-

Retirement Planning

-

Marriage

-

Child's Education

-

Medical Emergency

-

International Travel etc.

5. Here are a few steps that you must take to fulfill the dream of wealth creation or to become a crorepati:

-

Consider Your Finances Before Investing

When you want to become a crorepati by investing Rs 10,000 in a Monthly SIP, you must manage your finances properly. For example, plan your monthly expenditure carefully if your monthly income is Rs 40,000. It will give you an idea of how much you have to spend monthly so that Rs 10000 can be saved and invested every month. If your monthly expenditure is 20000-25000 rupees, you save around 15 to 20 thousand rupees, out of which you can start investing in SIP from 10000 rupees.

-

Choose The Right Financial Planner

Sometimes we can get excited and start investing without consulting anyone. However, it would be best to talk to your financial planner before investing a large amount. Since they are experts in investment matters, they will be able to guide you properly. Therefore, please pay particular attention while choosing your financial planner so that they can help you in enhancing your investment plans.

-

Manage Expenses Wisely

When you eventually want to become a crorepati, you must manage your expenses wisely from today itself. Since you want to become a crorepati with an investment plan, you have to save more and more to invest that money and become rich as soon as possible. You must also understand that unwanted expenses lead to more financial burdens and can affect your investment plan. So go ahead with your savings plan as much as possible. As the saying goes, 'money saved is money earned.

-

Invest In The Right Plans

One can also invest in different options through SIP. For example, since you are ready for long-term investment, you can invest in 2-3 votes through SIP to ensure steady growth of wealth over time. Hence it becomes essential to choose the right portfolio, to reduce the risk and maximize the returns.

-

Bank Fixed Deposits

The shallow risk with only a 7 percent annual return.

6. SIP In Different Mutual Funds

6.1 SIP in Index Mutual Fund

One can start by investing in an Index Mutual Fund through SIP. It carries moderate risk and gives 10-12 percent returns.

6.2 SIP in Equity Mutual Fund

Choose the right equity in it. Large-cap, mid-cap and blue-chip. You can expect to get a 14-18% return. The risk is slightly higher.

6.3 SIP in Balanced Mutual Fund

12-14 percent return.

7. Patience Plays a Key Role While Investing

Becoming a crorepati is not an overnight game. You also know that the financial market is always volatile and known for its unpredictable ups and downs. So whenever you invest, be aware of the market conditions. Pay more attention to your long-term financial goals. Consistently meet your investment payments on time. Patience is an essential quality of an investor. Your patience is necessary to play a big game in the investment world. Remember that the success of becoming a crorepati is not going to happen in a day or a year.

8. Apply Mutual Fund SIP 10/15/18 Rule

If you invest Rs 10,000 per month through Mutual Fund SIP and you get an expected return of 15% per annum on this investment, then the happiest thing for you is that you will become a crorepati in the next 18 years. If you are currently 25, then at 43, you will be the first crorepati in your family.

9. Final Thought

As we saw, becoming a crorepati and creating good money is possible. You can also quickly become a crorepati in the coming years with a monthly SIP of Rs 10000. But this life-changing opportunity also expects something from you – your time, consistency, and your patience.

Frequently Asked Questions

A systematic Investment Plan (SIP) is an investment avenue offered by mutual funds. Through SIP, one can invest a fixed amount at regular intervals. It is one of the best and easiest ways to invest in Mutual Funds.

If you want to become a millionaire through SIP, apply the rule of 10/15/18, ie.

- invest Rs 10,000 per month

- the expected return of 15% per annum

- For 18 years Tenure

Patience is an essential quality of an investor. Your patience is necessary to play a big game in the investment world. Remember that the success of becoming a crorepati is not going to happen in a day or a year.

.webp)