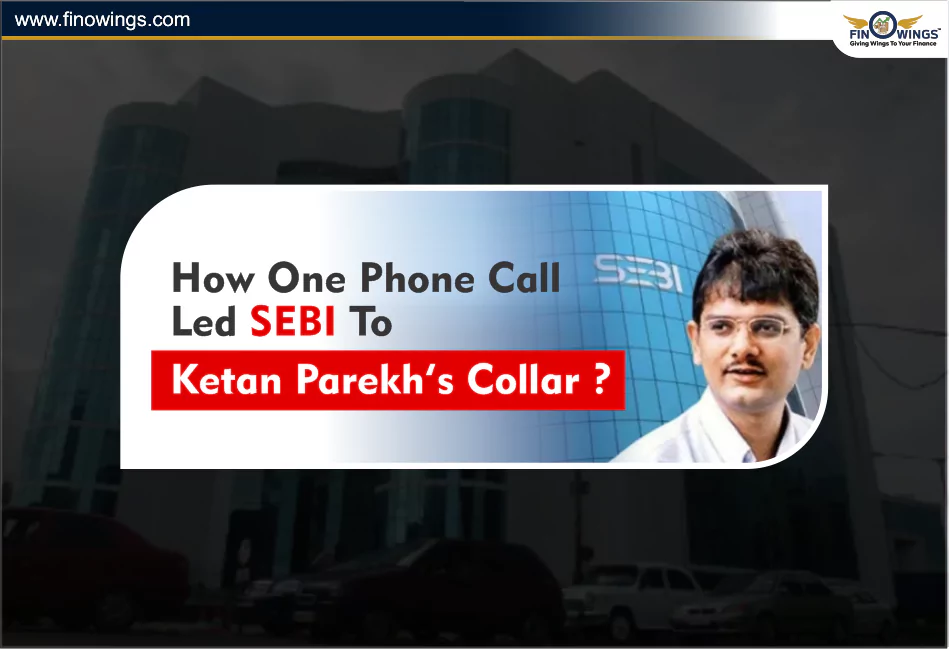

Home >> Blog >> How One Phone Call Led SEBI To Ketan Parekh’s Collar?

How One Phone Call Led SEBI To Ketan Parekh’s Collar?

Table of Contents

The market regulator SEBI has discovered a unique front-running case involving Singapore-based trader Rohit Salgaocar and stock market operator Ketan Parekh, who was previously imprisoned and subsequently blacklisted from the securities market for 14 years for his involvement in the 2000 scam. This time one phone call helped SEBI to expand its grip to catch Mr. Parekh.

SEBI banned Ketan Parekh and the other two from participating in Securities markets.

Today’s blog is all about 2000 Scam main villain Ketan's latest scam and how his wife’s phone call unintentionally helped SEBI to catch him.

Detailed Video

What is Ketan Parekh Scam?

The securities market has been banned for Ketan Parekh, Rohit Salgaonkar, and Ashok Kumar Poddar as the 3 were found guilty of a front-running scheme, through which an illegal profit of Rs.65.77 crores was earned. Many of you might remember Ketan Parekh from the famous Ketan Parekh Scam (K-10 scam) in 2001 for a mega scam of Rs.40,000 crores.

What is Front Running?

Front-running is an activity by which brokers or traders use Non-Public Information (NPI) about anticipated large orders to buy securities ahead of it being made in an attempt to impact the prices and pocket an easy profit. Here, Parekh and his accomplices used NPI and traded through accounts of small front-runners (FRs).

These FRs indulged in very complex trading strategies for their gain, knowing that client orders were big. The flow of communication was between Parekh and these FRs, enabling them to trade under different identities and codes to cover these movements.

What Makes This Scam Different?

This scam involved blue-chip stocks like that of HDFC Bank, L&T, Titan, and Policy Bazaar, rather than penny or low capitalization stocks like most scams. It manipulated and planted extraordinary trading volumes in these stocks through various ruses to mislead retail investors.

The prominent trading strategies used were:

-

Buy-Buy-Sell-Buy (BBSB)

-

Sell-Sell-Buy-Sell (SSBS)

-

Buy-Sell-Buy

-

Sell-Buy-Sell.

The Operandi Modus

This is how it operated:

-

To carry out NPI-based deals, Parekh spoke with FRs.

-

Through a variety of brokers, trades were carried out under fictitious names, such as "Jack" for Parag Parekh.

-

For trade execution, Singapore-based SCPL, of whom Salgaonkar is the only director, inked MOUs with brokers such as Motilal Oswal and Nuvama.

-

According to SEBI's investigation, Motilal Oswal paid Salgaonkar Rs.8.06 crore and Nuvama Rs.19 crore in commissions or referral fees. Their illegal operations were made easier by this complex network.

How SEBI Revealed His Network?

At least 10 mobile numbers registered under various identities were discovered by SEBI at Parekh's Mumbai home. Additionally, Parekh's mobile numbers followed him everywhere. Using these cell numbers, Parekh obtained non-public information (NPI) on stock prices from a trader headquartered in Singapore. He then shared this information with his network of front entities so that transactions could be executed on his behalf.

On March 15, 2023, Ketan Parekh attended the SEBI headquarters on behalf of NH Securities, another entity involved in an ongoing lawsuit. Parekh provided a copy of his Aadhaar card, which had the number "XXXXXXX32573" and the mobile number "XXX0308243," as identification. Additionally, the mobile number "XXX6562996" was handwritten on his visiting slip in SEBI, in addition to the same mobile number that was on his Aadhar card. Some astute detectives in SEBI were able to track down Parekh with just these two mobile numbers.

"First of all, SEBI has obtained the subscriber details of the contact numbers that Parekh had given to SEBI during his visit. It came to knowledge that one of the numbers belonged to Parekh's wife Ms. Mamta at the address of Zaver Mahal, 19/b, Marine Drive, Marine Lines (Mumbai). This number has been active since May 28, 2001.

Also, in his statement to SEBI dated December 12, 2023, Parekh confirmed that the mobile number "XXX0308243" belongs to his wife. Also, the address of Mamta Parekh was the same as that mentioned in the Aadhaar card of Ketan Parekh. Thus, it was established prima facie that Ketan Parekh (KP) used the phone number "XXX0308243" which belonged to his wife.

SEBI now dug up the location of KP's wife's number, which was matched up with the other mobile numbers (uncovered during various search and seizure raids) that were communicating with the NPIs and giving orders to the front entities for the execution of the trades. Thus, the entire trail was revealed by the location data of Parekh's phones, the suspects' WhatsApp chat information, and the testimonies of important implicated parties.

SEBI considered IMEI analysis of various phone numbers so as to prove the link to KP. The unique 15-digit serial number that identifies a specific cell phone is the IMEI (International Mobile Equipment Identity) number. On analysis of IMEI numbers associated with the contact numbers gathered, it was found that various contact numbers were used in the same mobile devices.

Call Record Data (CDRs) of various contact numbers associated with KP were further analyzed to identify the location of the said numbers during nighttime (i.e. between 9 PM to 6 AM) during the course of the investigation. All of these mobile numbers were located at the home address of KP i.e. Zaver Mahal, 19/b, Marine Drive, Mumbai, Maharashtra – 400020

(Source: Business World)

SEBI's Action Now and Further Course

The accused are issued a notice by SEBI giving a period of 21 days for their response. Undoubtedly, the prompt action taken by SEBI will also bring in several questions regarding the loopholes in the Indian regulations where all such scam operations find an opportunity to operate.

Impact on Retail Investors

What investors must do:

-

Stay updated with all market happenings.

-

Use data-based tools to analyze movements in stocks.

-

Don't respond to the periodic whims of the markets in a knee-jerk fashion.

Conclusion

The Ketan Parekh scam is a serious reminder that even the most reputed stocks can succumb to manipulation. Learning how such schemes work and being cautious can help retail investors stay away from fraud.

What do you think SEBI will do to avoid this type of scam? Comment below with your views and share this blog to spread awareness among fellow investors. Together creating an informed as well as resilient investing community.

DISCLAIMER: This is NOT any buy or sell recommendation. No investment or trading advice is given. The content is purely for educational and information purposes only. Always consult your eligible financial advisor for investment-related decisions.