Home >> Blog >> Pump and Dump Schemes: How To Avoid One

Pump and Dump Schemes: How To Avoid One

Table of Contents

Are you stuck in a stock that has never recovered after falling from its all-time high? Many traders have faced this situation. If you have, do share the name of the stock. Understanding why this happens is crucial. These stocks often don’t recover because they were part of a “pump and dump” scheme, a dangerous trap that targets retail traders. This strategy can break traders’ confidence, destroy their capital, and leave them financially devastated.

In today’s blog, we’ll discuss what pump and dump is, some examples of pump and dump stocks, how it works, and how you can avoid falling into this trap.

What is Pump and Dump?

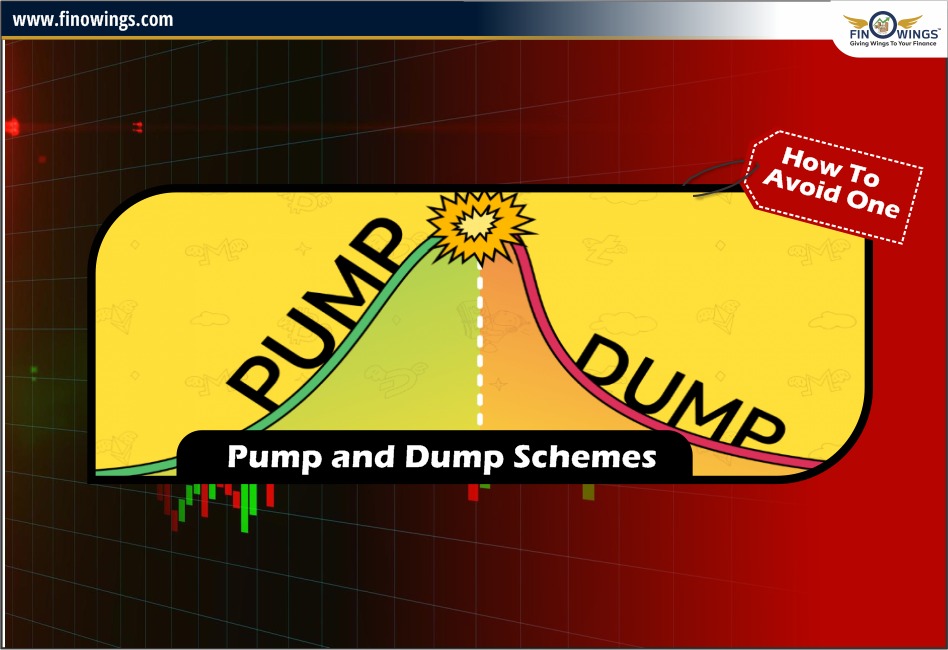

Pump and dump is a fraudulent scheme where the price of a stock is artificially inflated through false or misleading promotions. Once the price is pumped up, the manipulators sell off their shares at the high price, causing the stock price to come down drastically, and leaving unsuspecting retail traders with significant losses.

For a detailed analysis you can always refer toh the video provided below.

How Does Pump and Dump Work?

Here’s a breakdown of the process:

-

Promotion: The stock is heavily promoted through various channels, including messages, TV, blogs, and social media. Positive news is spread about the company, creating a buzz and attracting retail investors.

-

Inflation: As more people buy into the hype, the stock price rises. This upward movement is often shown on monthly charts, making it appear as though the stock is a good investment.

-

Sell-off: Once the price reaches a peak, the promoters sell their shares, causing the stock price to crash. Retail investors who bought into the hype are left with shares worth significantly less than what they paid.

Recognizing Pump and Dump Schemes

Let’s take a hypothetical example. Suppose you receive an SMS promoting a stock called “Circuit Upper Circuit.” The message highlights how the stock is rapidly gaining value, creating a sense of urgency and fear of missing out (FOMO). You might also see ads promoting this stock while scrolling through various platforms. These ads often appear on websites, blogs, and even YouTube videos, creating the illusion of legitimacy.

We have attached some images to help you understand how these messages look like..

One common characteristic of these schemes is that the stocks involved are often penny stocks—low-priced, high-risk stocks that are easy to manipulate. If you notice a stock being aggressively promoted, chances are it might be part of a pump and dump scheme.

How to Avoid Pump and Dump Traps

-

Be Skeptical of Promotions: If you receive unsolicited messages or see ads promoting a stock, approach with caution. Genuine investments don’t need aggressive marketing.

-

Research the Stock: Before investing, research the company thoroughly. Look at its financial health, management team, and market position. Reliable stocks have solid fundamentals and steady growth, not sudden spikes due to promotions.

-

Watch for Warning Signs: Stocks involved in pump and dump schemes often show continuous upper circuits followed by sharp declines. Genuine stocks typically have more stable and gradual price movements.

-

Avoid Penny Stocks: Penny stocks are risky and often targeted by fraudsters. Investing in well-known, established companies reduces the risk of falling into a pump and dump trap.

-

Consult Reliable Sources: Rely on trusted financial news sources and analysis rather than unverified promotions. Check the credibility of the information and the reputation of the source.

Practical Steps to Stay Safe

-

Example Scenario: Suppose you receive a message promoting “Circuit Upper Circuit.” The stock is being aggressively advertised, and you notice it’s a penny stock. You should be cautious and not invest based solely on these promotions.

-

Check for Patterns: Look at the stock’s price history. If you see a pattern of continuous upper circuits followed by sharp drops, it’s a red flag.

-

Research and Verification: Verify the information from multiple reliable sources. Don’t rely on a single promotional message. Check official financial statements, company news, and market analysis.

By staying informed and cautious, you can avoid the pitfalls of pump and dump schemes. Share your experiences and let others learn from them. Being aware and educated is your best defense against fraudulent schemes in the stock market.

We hope you found this information helpful. Share your thoughts and experiences in the comments, and don’t forget to share this blog with others to spread awareness.

Disclaimer: This analysis is for informational purposes only and should not be considered as investment advice. Always do your research and consult with a financial advisor.

Want to start your journey in stock market trading and investing? Join our Stock Market Class to become beginner to expert trader! We cover everything from the basics of trading to advanced strategies for picking stocks. Plus, we're offering a special discount for women and students. Don't miss out - enroll now and kickstart your path to success in the stock market! Open a world of Stock Market by Opening a Demat Account with your favourite Broking firm & Get a trading Strategy worth Rs.15,000!

Frequently Asked Questions

A pump and dump scheme is a fraudulent practice where the price of a stock is artificially inflated through false or misleading promotions. Once the price peaks, the manipulators sell off their shares, causing the stock price to crash and leaving retail investors with significant losses.

You can recognize a pump and dump scheme by looking for aggressive promotions of a stock, especially through unsolicited messages or ads. Warning signs include sudden, sharp price increases followed by drastic drops, particularly in penny stocks, which are low-priced and high-risk.

Pump and dump schemes often target penny stocks, which are low-priced, high-risk stocks that are easy to manipulate due to their low trading volume and lack of scrutiny from regulatory bodies.

To avoid pump and dump schemes, be skeptical of unsolicited stock promotions, thoroughly research the stock and the company, watch for warning signs like continuous upper circuits followed by sharp declines, avoid penny stocks, and rely on information from trusted financial news sources.

If you suspect a stock is part of a pump and dump scheme, refrain from investing based on the promotions. Instead, verify the information from multiple reliable sources, check the stock’s price history for suspicious patterns, and consult official financial statements and market analyses.