Home >> Blog >> Stop Loss Hunting Strategy: What Is It & How to Avoid It?

Stop Loss Hunting Strategy: What Is It & How to Avoid It?

Table of Contents

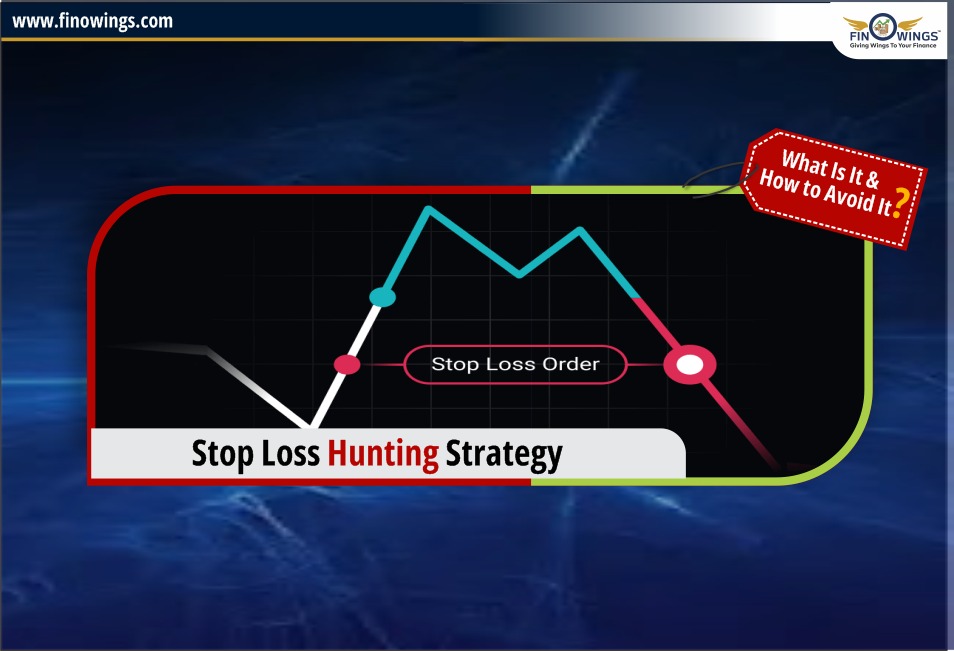

Have you ever had your stop loss hit, and the stock bounced back right after? This is a common experience for many traders and is often referred to as "stop loss hunting."

Now what stop-loss hunting is, why it happens, and how you can avoid SL Hunting. We will go through all of this. And if you're new here, you can always consider this place for latest market updates and valuable insights.

What is Stop Loss Hunting?

In the stock market, the big institutional players, often called stock operators, can be seen as hunters, while retail traders like us are the prey. These big institutions target the stop losses (SL) of retail traders to make profits. It’s like a jungle out there where the hunters aim to "hunt" the stop losses and take advantage of the situation.

How Does Stop Loss Hunting Work?

Imagine a stock is trading at a certain support level. Retail traders set their stop losses just below this support. The market might suddenly crash, hitting these stop losses before bouncing back up. This rapid fall and recovery can be seen as a shadow on the chart, indicating that many stop losses were hit. This shadow forms at the bottom, showing that the big players have triggered many stop losses.

For instance, if a stock has a psychological stop loss level at ₹98 while trading at ₹100, big players might sell aggressively to push the price down. This triggers the stop losses set by retail traders, causing the price to fall further as new traders see the breakdown and create short positions. Once enough stop losses are hit and the selling pressure increases, these big institutions start buying the stock at the lower price, driving it back up.

Let’s see this with an example on charts. Below is the attached charts of Tata Motors and SL hunting can be seen very clearly. How the price broke the support and the very next candle bounced and stock boomed.

You can always refer to the video for a better understanding of this whole process. Link has been attached below.

Why Do Institutions Hunt Stop Losses?

There are two main reasons:

-

Generating Liquidity: When liquidity is low, institutions hunt stop losses to create more buying opportunities. By pushing the price down and triggering stop losses, they increase the number of sellers, which allows them to buy large quantities at a lower price.

-

Buying at a Better Price: Institutions prefer to buy at lower prices to improve their average purchase cost. For example, buying a stock at ₹98 instead of ₹100 makes a significant difference when dealing with large orders worth crores of rupees. By hunting stop losses, they can purchase substantial amounts at a cheaper rate.

How Do Institutions Know Where Your Stop Loss Is?

Support and resistance levels are common knowledge among traders. Most retail traders place their stop losses around these psychological levels. Institutions exploit this by targeting these areas, knowing that a large number of stop losses will be triggered.

How to Avoid Stop Loss Hunting

While you can't prevent institutions from engaging in stop loss hunting, you can adjust your strategy to minimize its impact:

-

Use a 5-Minute Chart: When you suspect a stop loss hunt, check the 5-minute chart. If the market breaks down and there is no significant sell signal within the next five minutes, it might just be a temporary panic. Hold your position and wait to see if the market stabilizes or turns sideways.

-

Avoid Setting Obvious Stop Losses: Instead of placing your stop losses at common psychological levels, consider setting them at less obvious points. This can reduce the likelihood of your stop loss being targeted by institutional players.

-

Stay Informed and Patient: Always stay informed about market conditions and be patient. Don't react hastily to sudden price movements. Analyzing the situation calmly can help you avoid falling prey to stop loss hunting.

By understanding the tactics used by big institutional players and adjusting your approach, you can protect yourself from stop loss hunting and improve your trading strategy. Remember, the stock market is like a jungle, and being aware of the hunters' tactics can help you navigate it more effectively. Share this knowledge with fellow traders and stay tuned for more insightful updates.

Disclaimer: This analysis is only for informational purposes and should not be considered as investment advice. Always do your research and consult with a financial advisor.

Frequently Asked Questions

Stop loss hunting refers to a strategy employed by large institutional players, known as stock operators, to trigger the stop loss orders set by retail traders. This tactic is used to create liquidity and buy stocks at lower prices. By driving the stock price down temporarily to trigger stop losses, these institutions can then buy significant amounts of stock cheaply before allowing the price to rise again.

Big institutions hunt stop losses primarily for two reasons:

- Generating Liquidity: By triggering stop losses, they create a surge in selling activity, which provides the liquidity needed to buy large quantities of stock.

- Buying at a Better Price: Institutions aim to reduce their average purchase cost by buying stocks at lower prices after triggering retail traders' stop losses.

Institutions identify common stop loss levels by analyzing support and resistance levels, which are well-known among traders. Most retail traders place their stop losses around these psychological levels. By targeting these areas, institutions can predict where a significant number of stop losses are likely set and trigger them accordingly.

To avoid stop loss hunting, consider the following strategies:

- Use a 5-Minute Chart: Check the 5-minute chart if you suspect stop loss hunting. If there's no significant sell signal within five minutes of a breakdown, it might just be a temporary move. Hold your position to see if the market stabilizes.

- Set Non-Obvious Stop Losses: Avoid placing stop losses at common psychological levels. Instead, set them at less obvious points to reduce the likelihood of being targeted.

- Stay Informed and Patient: Keep yourself updated on market conditions and avoid making hasty decisions based on sudden price movements. Analyzing the situation calmly can help you make better trading decisions.

Imagine Tata Motors is trading at a support level of ₹100. Many retail traders might set their stop losses just below this level, say at ₹98. Institutions might aggressively sell to push the price down to ₹97, triggering these stop losses. As the stop losses are hit, more selling pressure builds up, causing the price to fall further. Once the institutions have triggered enough stop losses and increased selling pressure, they start buying the stock at the lower price, say ₹97, driving the price back up above ₹100. This whole process creates a shadow on the chart, indicating where the stop losses were triggered.